Capital gains on sale of second home calculator

This means you dont pay any CGT on the first 12300 you earn from the sale of your property. Home equity loan calculator.

Solved Can You Avoid Capital Gains Taxes On A Second Home

When you sell a capital asset the difference between the purchase price of the asset and the amount you sell it for is a capital gain or a capital loss.

. Meanwhile long-term Capital Gains Tax for crypto is lower for most taxpayers. FY 2017-18 then that Asset is treated as Short Term Capital Asset. Capital Gains Tax Allowance on Property.

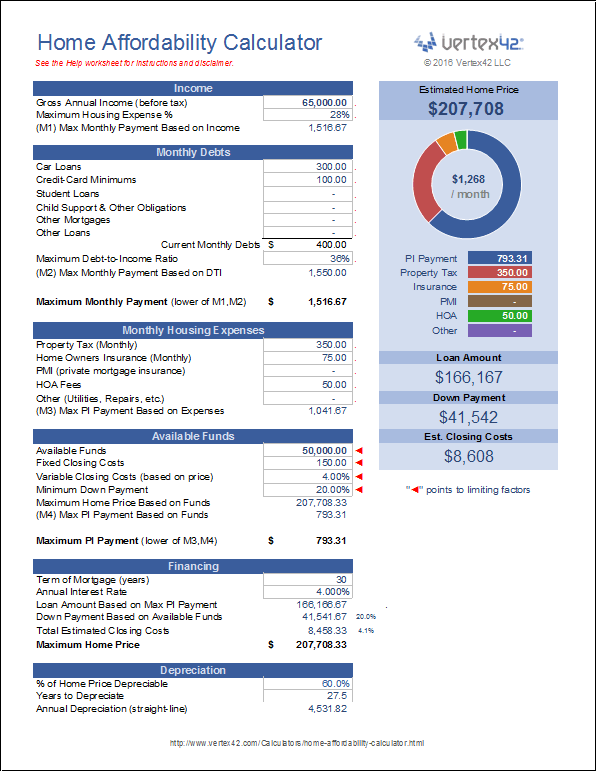

The Czech income tax rate for an individuals income in 2010 is a flat 15 rate. Capital Gains Tax on Sale of Property. Simply enter your total earnings the sale and purchase price of the property and your tax-deductible.

For the sale of a second home that youve owned for at least a year the capital gains tax rates for 2019 are 0 percent 15 percent or 20 percent depending on your income in that year including the gain on the sale of the property. The Capital Gains Tax allowance on property for 2022 - 2023 is 12300. This calculator has been produced for information purposes only.

The closest thing to a specific tax is the bright-line test for property sales. Up to 500000 of their home sale profit is completely tax free. If youre filing jointly as a married couple that capital gains exemption goes up to 500000.

If the capital gain is 50000 this amount may push the taxpayer into the 25 percent marginal tax bracket. Claiming capital losses. Real property is a capital asset so it is subjected to capital gains tax once its sold.

Corporate tax in 2010 is 19. With the sale of a second home you will typically be responsible for paying taxes on any profits capital gains you make at a rate of up to 20 depending on your tax bracket. Your total taxable gain or net profit is.

Capital gains and losses are classified as long-term or short-term. A second home holiday home business premises and land. Married couples that jointly own their home get an even better deal.

So for 2022 the maximum you could pay for short-term capital gains on rental property is 37. You wont need to pay CGT for the time a property was your main residence plus the past nine months of ownership even if you werent living in the property during those. Capital gains taxes are a type of tax on the profits earned from the sale of assets such as stocks real estate.

You pay 127 at 10 tax rate for the next 1270 of your capital gains. If you earn less than 40400 including your crypto for the 2021 tax year then youll pay no long-term Capital Gains Tax at all. So if you have assets not limited to property that you earned income on you can lower your gains by.

If your property sale falls under this you will pay tax based on your total income with tax charged at your marginal rate ie. Gains on the sale of collectibles rental real estate income collectibles antiques works of art and stamps are taxed at a maximum rate of 28. You pay 1286 at 20 tax rate on the remaining 6430 of your capital gains.

Our Capital Gains Tax calculator gives you an estimate of how much you could have to pay in Capital Gains Tax CGT when you sell your property in the UK. Updated for tax year 2022-2023. Home equity line of credit HELOC calculator.

To apply the home sale exclusion your property must pass two tests. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. You pay no CGT on the first 12300 that you make.

The short-term capital gains tax rate is whatever your normal income tax rate is and it applies to investments you hold for less than one year. Capital gains from the sale of shares by a company owning 10 or more is entitled to participation exemption under certain terms. If you have sold real estate property you will have to report any capital gains or losses on Schedule 3 the capital gains and losses form.

A capital gain represents a profit on the sale of an asset which is taxable. However homeowners have a unique perk when they decide to sell their homethey can exclude up to a 250000 gain. In your case where capital gains from shares were 20000 and your total annual earnings were 69000.

The taxpayer will have to recognize a capital gain from the sale of the land. In most cases youll use your purchase and sale information to complete Form 8949 so you can report your gains and losses on Schedule D. Real estate property includes residential properties vacant land rental property farm property and commercial land and buildings.

Capital gains tax on your main home In most cases you wont need to pay CGT when selling the property you live in because you will be entitled to private residence relief. For 2022 the capital gains tax exclusion limit for the sale of a home is 250000 for single filers or up to 500000 for married couples who file a joint return. And consequently owe the remaining 50000 in capital gains.

As long as you lived in the property as your primary residence for a total of 24 months within the five years before the homes sale you can qualify for the capital gains tax exemption. The table below breaks down 2022 short-term capital gains tax rates by filing status. Capital gains in the Czech Republic are taxed as income for companies and individuals.

Weve got all the 2021 and 2022 capital gains tax rates in one. For example if you purchased the home for 400000 and sold it for 515000 you would be responsible for anywhere up to 20 of the 115000 profit or 23000. The capital gains from your home sale remember thats the profit not the total purchase price is under 250000.

Enter the purchase and sale details of your assets along with tax reliefs and our capital gains tax calculator will work out your tax bill including all tax rates and allowances. The potential capital gains tax on the sale would be 300000 which is the profit made from the sale. The Housing Assistance Act of 2008 was designed to provide relief for homeowners on the edge of foreclosure yet it.

Using the home sale exclusion the seller could exclude 250000 of the profit. Youll pay a 0 15 or 20 tax rate depending on your taxable income. Capital Gains on Sale of Second Home If you own multiple homes it may not be as easy to shelter sale profits as it was in the past.

According to the IRS the majority of taxpayers fall into the 15 percent bracket. Before delving into the capital gains tax property six-year rule its important to understand what constitutes a principal place of residence. Capital gains tax CGT breakdown.

For example if you earn a salary of 100000 and make a 400000 profit from a house sale you will pay up to 39 tax. The IRS allows taxpayers to exclude certain capital gains when selling a primary residence. 1050 1750 30 33 or 39.

More help with capital gains calculations and tax rates. You can also claim capital losses when you have capital gains. As a general rule main residence exemption disallows capital gains tax payable on the sale of the property you regard as your family home which is known as your principal place of residence.

If Land or house property is held for 36 months or less 24 months or less wef. Capital Gains Tax Exclusion. That figure only applies to people filing as a single homeowner.

As a mortgage broker were not able to offer tax advice. Long-term Capital Gains Tax rate. In this instance the taxpayer would pay 0 percent of capital gains tax on the amount of capital gain that fit into the 15 percent marginal tax bracket.

Following on from the previous example.

Trulia Mortgage Center Goes Live Agbeat Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

Reverse Mortgage Calculator Mls Mortgage Reverse Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

Fha Debt To Income Calculator Debt To Income Ratio Real Estate Advice Fha Loans

Fixed Vs Arm Mortgage Calculator Mls Mortgage Arm Mortgage Amortization Schedule Mortgage Amortization Calculator

Mortgage Calculator Monthly Payments Screen Mortgage Loan Calculator Mortgage Payment Calculator Mortgage Loan Originator

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

Home Ownership Expense Calculator What Can You Afford

2022 Capital Gains Tax Rates By State Smartasset

/house-model-and-calculator-on-table-for-finance--selling-home-concept---bangking-concept-954596268-455a46f351ae40709b4a015dcfd9c0d0.jpg)

Principal Residence Exclusion Definition

Real Estate Concept House On Calculator Mortgage Stock Photo Ad Concept House Real Estate Ad Refinance Mortgage Refinance Loans Real Estate

Fha Home Loan Calculator Easily Estimate The Monthly Fha Mortgage Payment With Taxes Mortgage Loan Calculator Fha Mortgage Mortgage Amortization Calculator

Pros And Cons Of Using A Home Equity Loan To Fund College Mortgage Tips Reverse Mortgage Homeowner Taxes

Home Affordability Calculator For Excel

How Much Is Capital Gains Tax On Real Estate Plus How To Avoid It

/housecalculator-56a7dc723df78cf7729a0745.jpg)

Mortgage Calculator

Capital Gains On The Sale Of A Second Home Smartasset

Capital Gains Tax Calculator The Turbotax Blog